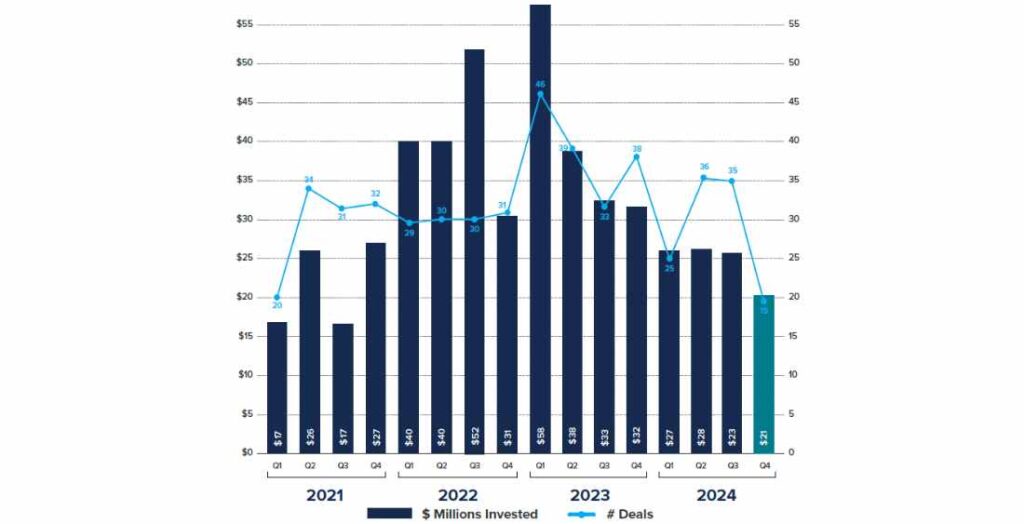

Canada’s venture capital market hit $7.86B in 2024, but for pre-seed startups, the reality is far less exciting. Investment at this stage plummeted to just $99M across 115 deals—a fraction of the total capital flowing into the ecosystem. If you’re an early-stage founder, that means one thing: securing funding is harder than ever.

But there’s a silver lining. Scarcity creates opportunity. If you understand the new funding landscape and play your cards right, you can still get the capital you need to grow.

Why Pre-Seed Funding is Struggling

The numbers don’t lie:

- Average pre-seed deal size dropped to $0.86M, well below the five-year average of $1.34M.

- Investors are more cautious, making fewer bets and focusing on later-stage companies.

- Canada’s IPO market is still cold, meaning VC firms are waiting longer for returns and taking fewer risks.

This means that fewer startups are getting funded, and those that do are raising less. But it also means less competition for investor attention and a chance for savvy founders to stand out.

What Startups Should Do Now

1. Find Non-Dilutive Capital First

When equity funding is tight, grants, tax credits, and government-backed loans can keep your startup moving. Programs like SR&ED, IRAP, and regional funding initiatives offer early-stage support without giving up ownership.

And don’t ignore venture debt—in 2024, startups raised $881M this way, double the amount from last year.

2. Show Investors Real Traction

With VCs pulling back, metrics matter more than ever. Investors aren’t taking big risks on ideas alone—you need real proof of demand.

- Revenue, customer growth, and engagement numbers can set you apart.

- Instead of chasing one big round, focus on milestone-based funding to de-risk your startup and attract follow-on investment.

3. Tap Into Active Early-Stage Investors

Some investors are still backing pre-seed startups—they’re just more selective.

- Angel groups like Golden Triangle Angel Network and Startup TNT are still funding promising early-stage companies.

- Accelerators like GSA, MaRS, and Investissement Québec can open doors to capital, mentorship, and networks.

The Bottom Line

Yes, pre-seed funding is in a slump, but startups that adapt, focus on traction, and explore alternative funding will still thrive. Investors want great companies—they’re just being more selective.

The startups that navigate this landscape wisely will be the ones leading the next wave of innovation. Will yours be one of them?